With the advancement in technology, more accountants and finance experts are moving towards the use of technology to optimize their work. And companies are moving towards online services to eliminate the need for in-house servers and locally installed software.

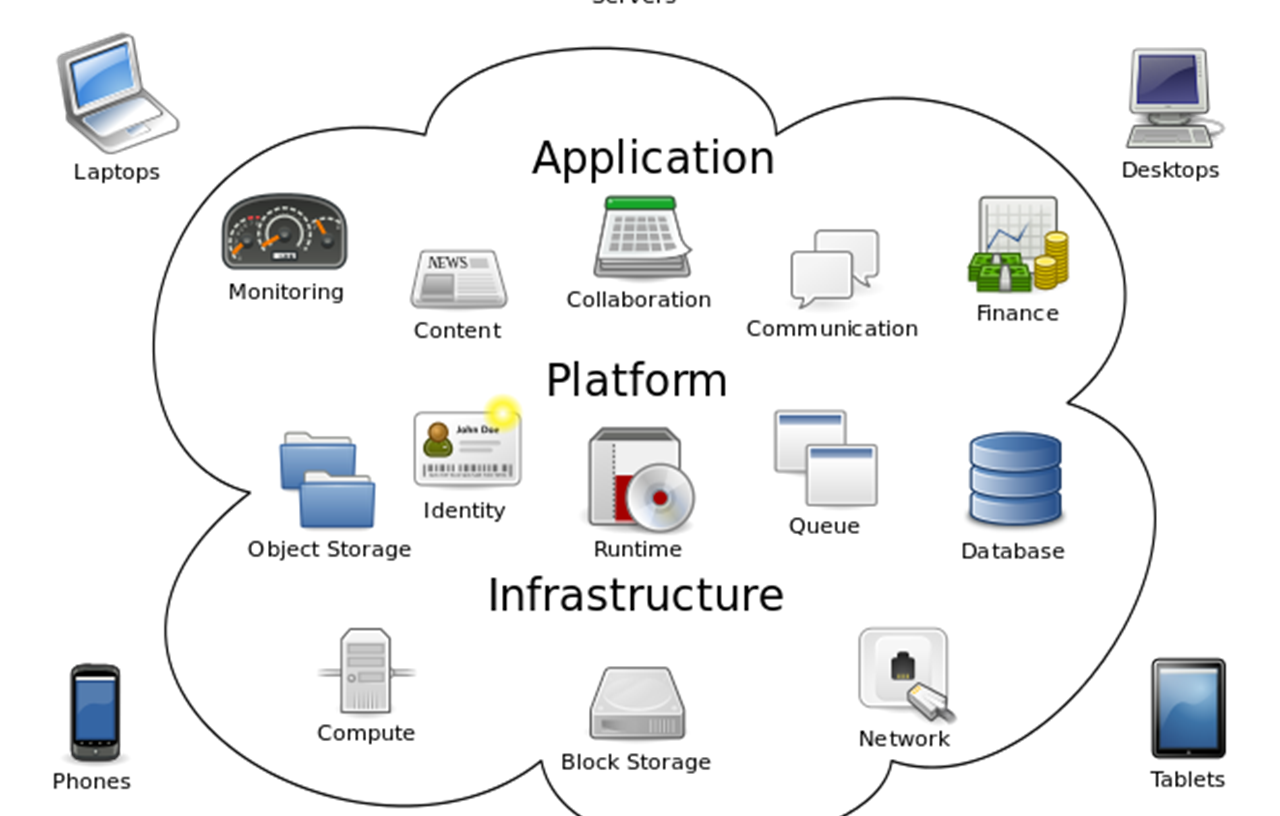

Cloud ERP enables a company’s accounting, operations management and reporting to run online. This means the company employees with the needed permissions will have access to financial data anytime, anywhere and from any device including mobile devices. The obvious advantages of Cloud ERP are almost similar to any other SaaS on the cloud which includes: eliminating upfront costs for all computing infrastructure such as hardware and data servers, reducing IT support services because IT is in the cloud, shrinking the cost of maintaining and supporting the application since the cloud vendor handles the updates and upgrades and enjoying the confidence that the data has been backed up and there is a disaster recovery plan.

However, having the ERP on the cloud, opened a lot of other potentials and opportunities. Potentials that uses ERP data to provide companies with more services and benefits. Cloud applications are mostly based on web services models which easily allow the exposure of web APIs. And web APIs usually refers to ease of integration and high interoperability. Because of ERP Cloud, we can see now solutions such as Kabbage (https://www.kabbage.com/) which is an online lending platforms that gives you business loans (in a form of a line of credit) on the spot by doing automatic quantification based on your online ERP data. Just hook Kabbage to your Cloud ERP such as XERO, QuickBooks, LIBRA and Sage and you will get your loan approval in minutes. Kabbage is designed to analyze your business data and verify your needs for funds.

Moreover, many other businesses (especially small and medium) rely on Cloud solutions like Salesforce.com to automate their CRM cycle (sales, marketing, services, customer support…). Such companies require ERP Cloud integrated with SalesForce to have the complete operations on the Cloud including the financial effects of those operations. “Easily Integrated with Salesforce” is now an important selling point in ERP Cloud solutions.

The number of financial systems being managed in the cloud is growing, according to the financial executives surveyed in the latest Benchmarking the Accounting & Finance Function report from Robert Half and Financial Executives Research Foundation (FERF).

With many businesses demonstrating a growing acceptance of cloud computing, this year’s survey by Robert Half asked financial executives whether their companies were using cloud services in their accounting and finance departments or planning to do so. Nearly half (42 percent) of U.S. respondents said they are using at least some cloud-based solutions, while 20 percent reported they are planning to in the future. More than a third (37 percent) said they have no plans to adopt cloud-based computing solutions. While a year ago, nearly half said they weren’t making that leap.

Small businesses have been especially eager to embrace cloud computing. Last year, only 20 percent said they were using the cloud, which grew to 41 percent this year — and 11 percent of the small businesses in 2016 said they use only cloud-based solutions for financial functions.

Comments